Essential for Financial Clarity

A CMA (Credit Monitoring Arrangement) report is crucial for startups seeking financial clarity and stability. It outlines the financial health of your business, helping lenders, investors, and financial institutions assess your creditworthiness. Whether you're applying for loans, securing investments, or presenting your business’s financial health, a well-structured CMA report is key.

How Opslify Can Help with Your CMA Report:

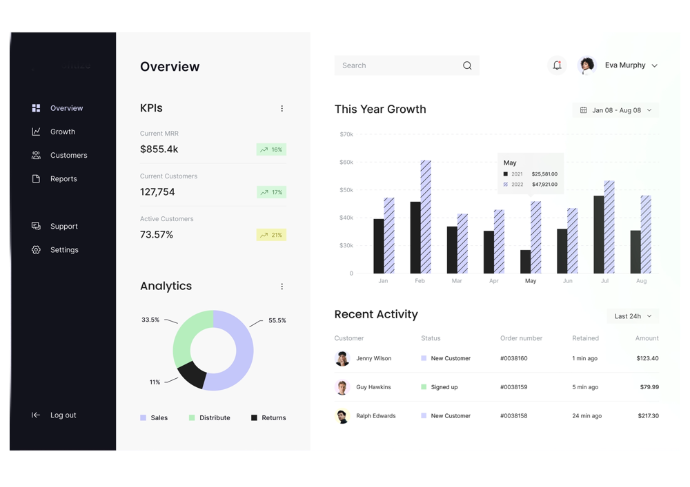

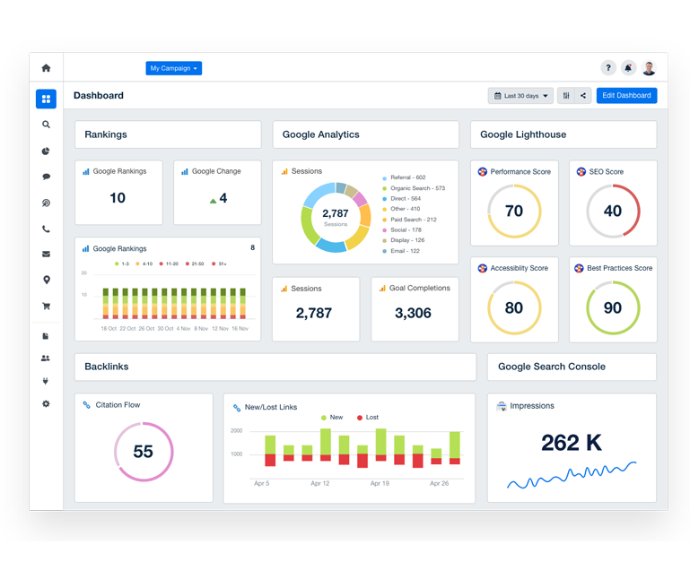

Expert Financial Analysis: Our team analyzes your financial data to create an accurate and comprehensive CMA report that reflects your startup’s true potential.

Tailored Reports: We customize your CMA report according to your industry, business size, and financial goals, ensuring it meets the requirements of lenders and investors.

Data-Driven Insights: Opslify’s professionals use precise data to generate insights on your cash flows, assets, liabilities, and revenue, ensuring transparency and reliability.

Benefits of CMA Report for Startups

A CMA (Credit Monitoring Arrangement) report is more than just a financial document; it’s a strategic tool that can unlock significant opportunities for startups. Here’s how a CMA report can benefit your business:

• Improved Access to Funding: Facilitates easier loan approvals and investment opportunities by showcasing financial health.

• Enhanced Financial Clarity: Provides insight into cash flows, liabilities, and assets for better decision-making.

• Builds Credibility: Increases trust with investors and lenders by presenting a solid financial picture.

Why Choose Opslify for Your CMA Report?

At Opslify, we understand that accurate financial insights are crucial for your startup's growth. Our team of experts is dedicated to delivering high-quality CMA reports that reflect your business's financial stability and future potential. Here's why startups trust us:

Expert Guidance: Our experienced professionals ensure that every aspect of the report is detailed, clear, and aligns with industry standards.

Comprehensive Insights: We provide thorough analysis, helping you understand your financial position, manage risks, and identify growth opportunities..