Building Your Path to

Profit

Get expert assistance from Opslify in creating robust financial models for your startup.

• Simple Financial Models: Tailored to your startup’s needs.

• Sample Models & Templates: Ready-to-use templates for easy customization.

• Revenue & Financial Projections: Clear and realistic forecasts to guide growth.

• Startup Financial Model Examples: Proven examples to inspire your planning.

Partner with Opslify to build a strong financial foundation and attract investors.

Financial Modelling for Startups: A Strategic Tool for Success

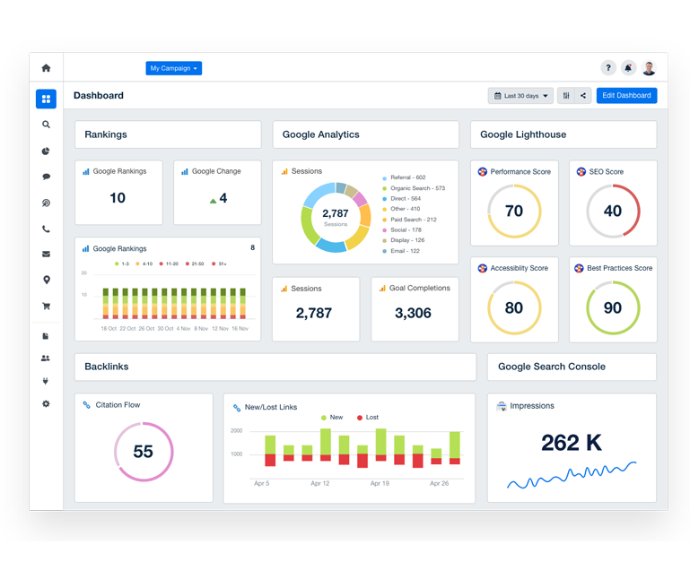

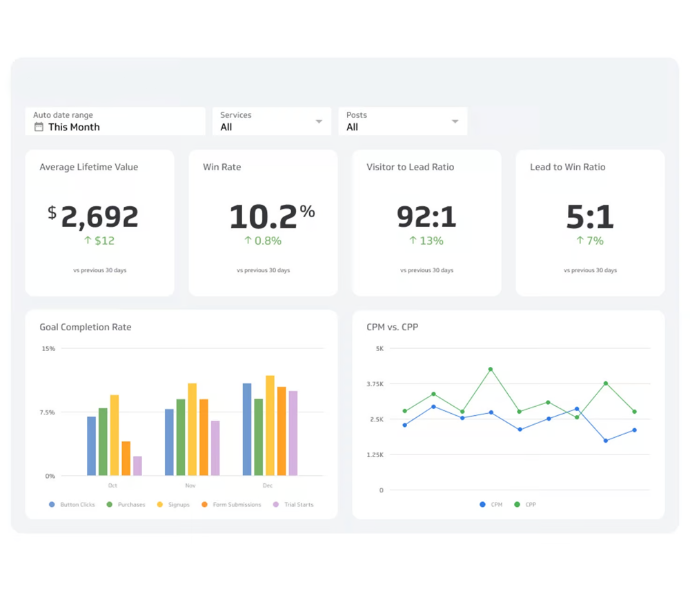

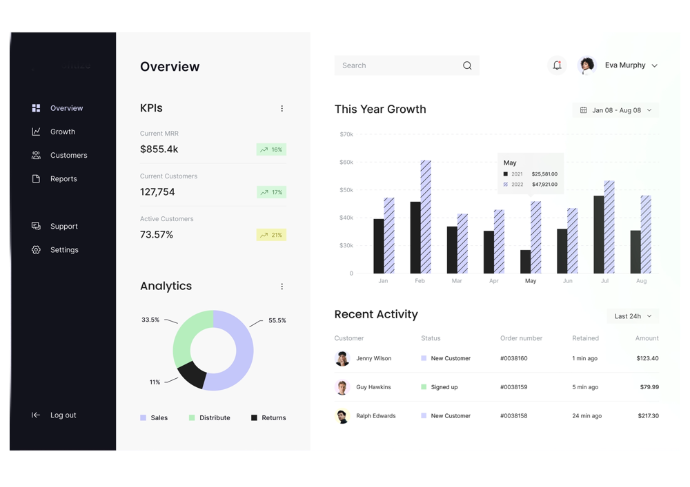

A financial model is essential for any startup, providing a numerical representation of your business strategy and vision. It helps forecast revenues, expenses, headcount, KPIs, and cash position. Whether you're an early-stage business or raising venture capital, a well-structured financial model is key to understanding your financial performance and growth potential.

Key Benefits of Financial Modelling for Startups:

• Roadmap for Success: A financial model acts as a strategic guide, offering insight into revenue generation, cost management, and profitability over time.

• Investor Communication: Essential for attracting investors, a solid financial model helps present clear projections and growth potential.

• Decision-Making Tool: Enables informed decisions based on historical data, assumptions, and future projections.

Key Components of a Startup Financial Model:

• Income Statement: Reflects total revenue, expenses, and profits, helping assess profitability and identify cost-saving opportunities.

• Balance Sheet: Provides a snapshot of assets, liabilities, and equity, assessing financial health and stability.

• Cash Flow Statement: Tracks cash inflows and outflows, providing insights into liquidity and financial flexibility.

• Debt Schedule: Details debt obligations, helping assess repayment schedules and overall debt load.

At Pinenest, we specialize in building financial models that align with your startup's goals. Whether you're planning for growth, preparing for funding, or managing expenses, we help you create a roadmap for success.

Benefits of Financial Modelling for Startups

Building a financial model is crucial for any startup, offering multiple advantages that drive success and attract investment. Here’s how financial modelling can benefit your business:

Quantifiable Data for Fundraising A strong financial model provides the clear, data-driven projections investors need before committing capital. It demonstrates your startup's growth potential and ability to generate profits, making it easier to secure funding.

Key Points for Creating a Financial Model for Startups

Creating an effective financial model is crucial for any startup looking to make informed decisions and forecast its financial future. Here are the key steps to ensure your financial model is both functional and clear:

Define the Problem and Goal

Clearly define the purpose and objectives of your financial model. Identify the specific challenge the model is addressing to guide your decision-making.

Limit Variables and Metrics

Focus on the key factors influencing your business’s financial health. Avoid overcomplicating the model with too many variables—simplicity is key.

Why Choose Opslify for Financial Modelling for Startups?

At Opslify, we specialize in delivering expert financial modelling services tailored to the unique needs of startups. Our experienced team understands the challenges and opportunities faced by emerging businesses and provides accurate, customized financial projections that support your startup’s growth.

With Opslify, you get:

• Tailored financial models that align with your specific business goals and challenges.

• Insights to help you make informed decisions and attract potential investors.

• Expert guidance on navigating complex financial landscapes, ensuring long-term success.

Trust Opslify to help you craft a financial model that drives your startup forward!